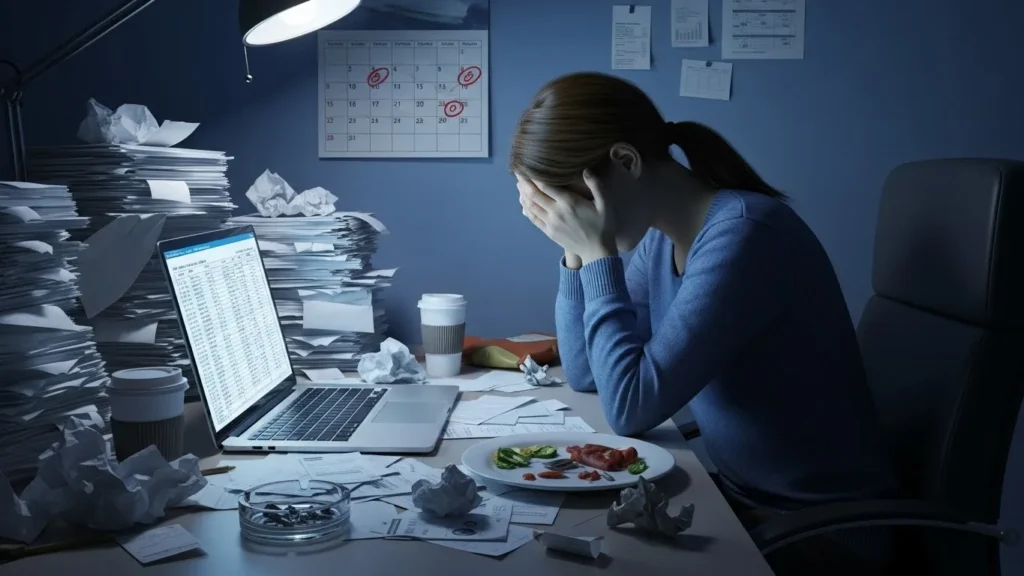

The Stress You Feel—But Can’t Quite Name

It’s not a dramatic financial crisis.

No debt collectors calling.

No bank account at zero.

No obvious emergency.

Yet something feels… heavy.

You feel mentally cluttered.

Small decisions feel harder than they should.

Money thoughts pop up at the worst times—late at night, mid-task, during quiet moments.

This is the emotional cost of financial disorganization.

And it affects far more people than financial advice blogs ever admit.

Financial Disorganization Isn’t About Being “Bad With Money”

Most people think financial stress comes from lack of money.

But in real life, stress often comes from lack of structure.

Financial disorganization looks like:

- Bills paid inconsistently

- Accounts spread across platforms

- No clear sense of cash flow

- Forgotten subscriptions

- Unopened emails from banks or insurers

None of this means you’re irresponsible.

It means your financial system doesn’t match your mental bandwidth.

The Brain Hates Unfinished Loops

Your brain is wired to track unresolved tasks.

When finances are disorganized, your mind constantly holds:

- “I should check that statement”

- “I need to sort those papers”

- “I don’t really know where I stand”

These open loops create background stress.

You’re not actively worrying—but your nervous system never fully relaxes.

This is why money chaos causes fatigue even when nothing “bad” is happening.

How Financial Disorganization Affects You Emotionally

The impact is subtle but powerful.

People with disorganized finances often experience:

- Low-grade anxiety

- Mental exhaustion

- Reduced focus

- Decision fatigue

- Irritability

- Avoidance behaviors

Over time, this stress leaks into:

- Work performance

- Relationships

- Sleep quality

- Confidence

Money chaos doesn’t stay in the bank account.

It follows you everywhere.

Why Small Financial Messes Feel So Heavy

A single overdue bill isn’t a big deal.

But uncertainty is.

Disorganization creates:

- Unknown balances

- Unclear obligations

- Surprise expenses

- Constant mental checking

Your brain interprets uncertainty as risk.

That’s why even minor money messes can feel emotionally overwhelming.

The Emotional Tax of “I’ll Deal With It Later”

Postponing financial organization seems harmless.

But every delay adds:

- A little more stress

- A little more shame

- A little less confidence

People often confuse avoidance with peace.

In reality:

Financial Disorganization vs Financial Hardship

It’s important to separate the two.

| Situation | Emotional Impact |

|---|---|

| Low income, organized | Stressful but stable |

| High income, disorganized | Constant anxiety |

| Moderate income, clear system | Sense of control |

| Any income, chaotic | Mental exhaustion |

Clarity reduces emotional weight—even without more money.

Why This Matters Today

Modern finances are fragmented:

- Multiple apps

- Auto-payments

- Digital statements

- Subscriptions everywhere

Money used to be visible.

Now it’s invisible—and disorganization grows silently.

Without systems, mental load increases automatically.

This is why financial clarity is no longer optional—it’s protective.

Real-Life Example: When “Nothing Was Wrong” Felt Wrong

A marketing professional earning well described feeling “always tense.”

No debt.

Regular income.

Savings growing.

But:

- Five accounts

- No single overview

- Bills on different dates

- Subscriptions untracked

Once everything was consolidated into one simple system, she said:

“I didn’t realize how much mental space money was taking.”

Nothing changed financially.

Everything changed emotionally.

The Hidden Link Between Money Chaos and Decision Fatigue

When finances are unclear, your brain is constantly evaluating risk.

This leads to:

- Overthinking purchases

- Delaying decisions

- Avoiding planning

- Feeling mentally drained

Disorganization forces your brain to work harder than necessary.

Clarity frees mental energy.

Common Mistakes That Keep People Stuck

Many people try to fix disorganization the wrong way:

- Overcomplicating tools

- Tracking every rupee or dollar

- Creating rigid budgets

- Trying to “optimize” everything

Complex systems collapse under stress.

Simple systems survive real life.

How to Reduce the Emotional Cost (Without Overhauling Everything)

You don’t need perfection.

You need containment.

1. Create One Source of Truth

Choose one place to see:

- Balances

- Upcoming bills

- Core accounts

Not everything—just essentials.

2. Group Financial Tasks

Handle money in one weekly block.

Not daily.

Not randomly.

This reduces mental intrusion.

3. Reduce Decisions, Not Spending

Automate:

- Fixed bills

- Savings transfers

Fewer decisions = less stress.

4. Accept “Clear Enough”

Clarity isn’t knowing every number.

It’s knowing:

“Nothing is hiding.”

5. Clean One Small Area First

Start with:

- One account

- One bill

- One document folder

Momentum builds confidence.

What Financial Organization Actually Gives You

People expect:

- Better savings

- Fewer mistakes

But what they feel is:

- Relief

- Calm

- Mental space

- Confidence

- Emotional safety

Organization is not control.

It’s permission to relax.

Key Takeaways

- Financial disorganization creates constant low-grade stress

- The emotional cost often exceeds the financial cost

- Uncertainty—not income—is the main stress driver

- Simple systems outperform complex ones

- Small clarity changes deliver big emotional relief

Frequently Asked Questions

Is financial disorganization a sign of poor discipline?

No. It’s often a sign that systems don’t match real life demands.

Why does money chaos affect my mood so much?

Because uncertainty keeps your nervous system alert, even when nothing is urgent.

Do I need a strict budget to feel organized?

No. Many people feel calmer with visibility, not restriction.

How long does it take to feel relief after organizing?

Most people report noticeable relief within days—not months.

What if I feel overwhelmed even starting?

Start smaller than feels necessary. Emotional safety comes before structure.

A Clean, Simple Conclusion

Financial disorganization isn’t just a money problem.

It’s an emotional drain.

A mental weight.

A quiet source of stress that steals energy every day.

You don’t need perfect finances to feel calm.

You need clarity that your money is contained, visible, and manageable.

And once that clarity exists, everything else feels lighter.

Disclaimer: This article is for educational purposes only and is not a substitute for personalized financial advice. Individual situations may vary.

Selina Milani is a personal finance writer focused on clear, practical guidance on money, taxes, insurance, and investing. She simplifies complex decisions with research-backed insights, calm clarity, and real-world accuracy.

Pingback: Why Financial Planning Feels Overwhelming (And How to Finally Make It Feel Manageable)