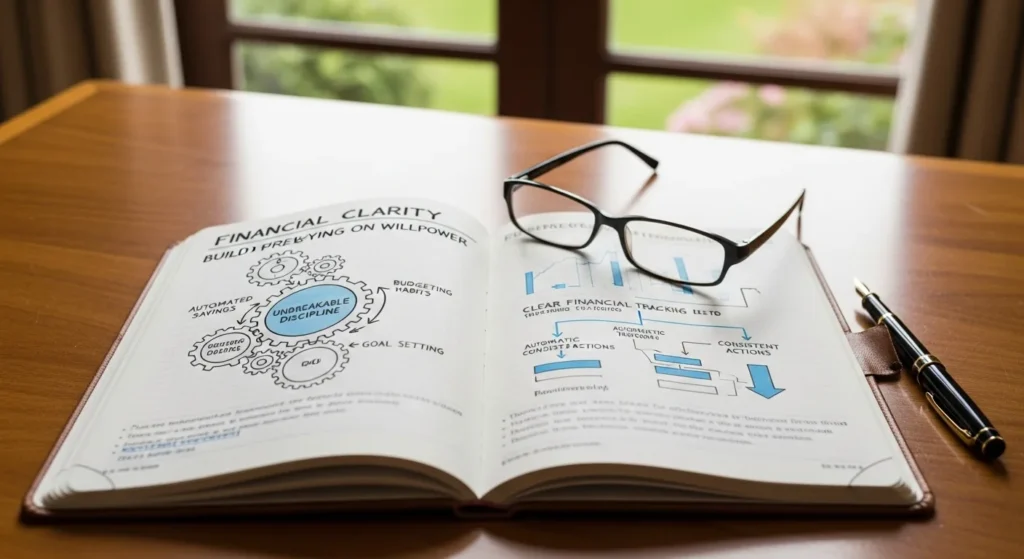

Most people believe financial discipline comes from willpower.

They think they need to be:

- More strict

- More motivated

- More “good” with money

But here’s the uncomfortable truth:

Discipline rarely fails because of weakness.

It fails because of confusion.

When money feels unclear, discipline feels exhausting.

When money feels clear, discipline becomes almost automatic.

This article explores how financial clarity quietly reshapes behavior—without pressure, guilt, or constant self-control—and why it matters more than any budgeting trick you’ve tried before.

The Real Enemy of Financial Discipline Isn’t Spending

People often blame their lack of discipline on spending habits.

But spending is usually a symptom, not the root cause.

The real enemy is:

- Vague goals

- Unclear numbers

- Hidden trade-offs

- Mental overload

When you don’t fully understand where your money is going—or why—it becomes impossible to make calm, consistent decisions.

Your brain defaults to:

- Short-term relief

- Emotional spending

- Avoidance

Not because you’re careless.

But because clarity reduces cognitive stress, and confusion increases it.

What Financial Clarity Actually Means (And What It Doesn’t)

Financial clarity doesn’t mean:

- Tracking every rupee obsessively

- Living on extreme budgets

- Constantly thinking about money

True clarity means:

- You know what matters

- You know where you stand

- You understand the trade-offs

It answers simple but powerful questions:

- What is my money for?

- What am I optimizing—comfort, freedom, security?

- What happens if I keep going exactly as I am?

Clarity creates context.

Context creates calm.

Calm enables discipline.

Why Confusion Makes Discipline Collapse

The brain hates uncertainty.

When your financial picture is fuzzy, your mind fills the gaps with stress and emotion.

That’s when:

- Small purchases feel harmless

- Big decisions get postponed

- Saving feels restrictive

- Spending feels relieving

This isn’t lack of discipline—it’s decision fatigue.

When every financial choice feels mentally expensive, the brain seeks shortcuts.

And the easiest shortcut is: do nothing or choose comfort.

How Clarity Changes Behavior at a Neurological Level

Clarity reduces cognitive load.

When information is structured and visible:

- Decisions take less energy

- Emotional reactivity decreases

- Long-term thinking becomes accessible

Research in behavioral finance consistently shows that people with clearer financial frameworks:

- Save more consistently

- Stick to plans longer

- Experience less money-related stress

Not because they’re better people—but because their brains aren’t constantly negotiating chaos.

Real-Life Example: Same Income, Different Outcomes

Consider two people earning the same income.

Person A (Low Clarity):

- Knows money is “tight”

- Doesn’t know exact numbers

- Avoids checking accounts

- Saves inconsistently

Person B (High Clarity):

- Knows fixed costs

- Knows flexibility range

- Understands future needs

- Automates decisions

Over time:

- Person A relies on willpower

- Person B relies on systems

Discipline drains Person A.

Discipline barely shows up for Person B.

Why Clarity Naturally Reduces Impulse Spending

Impulse spending often happens when:

- Trade-offs feel invisible

- Future consequences feel abstract

- Money feels unlimited in the moment

Clarity makes trade-offs visible.

When you see:

- What a purchase delays

- What it replaces

- What it costs long-term

Spending decisions shift from emotional to intentional.

You don’t say “I can’t.”

You say “I choose not to.”

That single shift changes everything.

Financial Clarity vs Financial Discipline: A Comparison

| Without Clarity | With Clarity |

|---|---|

| Willpower-based | System-based |

| Emotion-driven decisions | Intentional choices |

| Inconsistent habits | Stable routines |

| High stress | Calm confidence |

| Reactive spending | Proactive planning |

Discipline feels heroic without clarity.

With clarity, it feels ordinary.

Why This Matters Today (And Always Will)

Modern life constantly pushes financial noise:

- Subscriptions

- Lifestyle upgrades

- Social comparison

- Easy credit

Without clarity, it’s impossible to filter what matters.

Clarity acts like a lens—it doesn’t reduce choices, it prioritizes them.

In a world designed to fragment attention, clarity protects focus.

Common Mistakes That Block Financial Clarity

Many people unknowingly sabotage clarity by:

- ❌ Tracking too much data with no insight

- ❌ Setting vague goals (“save more”)

- ❌ Avoiding numbers entirely

- ❌ Mixing emotions with facts

- ❌ Changing systems too often

Clarity isn’t about complexity.

It’s about useful simplicity.

How to Build Financial Clarity Step by Step

1. Define One Primary Goal

Not ten.

One dominant goal—security, freedom, or flexibility—creates alignment.

2. Separate Fixed From Flexible

Know what’s locked in vs adjustable.

This reduces anxiety instantly.

3. Make the Invisible Visible

Use simple dashboards:

- Net worth trend

- Monthly surplus

- Emergency runway

Progress motivates discipline.

4. Automate the Obvious

Remove daily decisions:

- Automatic savings

- Automatic investments

- Automatic bills

Automation is clarity in action.

5. Review, Don’t Obsess

Monthly awareness beats daily anxiety.

Clarity grows with consistency, not control.

Hidden Tip: Clarity Improves Emotional Spending Control

Emotional spending often fills an emotional gap—not a financial one.

Clarity exposes when money is being used as:

- Stress relief

- Reward

- Distraction

Once seen, patterns lose power.

You don’t fight urges.

You understand them.

The Surprising Link Between Clarity and Confidence

Financial confidence doesn’t come from high income.

It comes from knowing:

- What you can handle

- What you can’t

- What actually matters

Clarity replaces fear with proportion.

Problems feel solvable.

Decisions feel grounded.

Discipline becomes self-respect—not restriction.

Key Takeaways

- Financial discipline grows from clarity, not force

- Confusion increases stress and impulsive behavior

- Clear systems reduce decision fatigue

- Visibility creates better long-term choices

- Automation turns clarity into consistency

- Calm beats control in personal finance

Frequently Asked Questions

1. Can clarity really replace discipline?

Yes. Clarity reduces the number of decisions discipline must manage.

2. Do I need detailed budgets for clarity?

No. Simple, meaningful numbers work better than detailed tracking.

3. How long does it take to feel the benefits?

Most people feel relief within weeks once systems are in place.

4. Does clarity help even with low income?

Especially. Clarity increases control when resources are limited.

5. What’s the first sign clarity is improving?

Money decisions feel calmer and less emotionally charged.

Conclusion:

Financial discipline isn’t about being stricter with yourself.

It’s about seeing clearly enough that good choices feel obvious—and bad ones lose their appeal.

When clarity leads, discipline follows quietly.

No pressure.

No guilt.

Just calm, consistent progress.

Disclaimer: This article is for general informational purposes only and does not replace personalized financial guidance.

Selina Milani is a personal finance writer focused on clear, practical guidance on money, taxes, insurance, and investing. She simplifies complex decisions with research-backed insights, calm clarity, and real-world accuracy.